Browse by Solutions

Browse by Solutions

How to setup Invoices Tax code for the United Mexican States?

Updated on March 8, 2018 09:10PM by Admin

Users in the United Mexican States can easily set up their online invoices to charge for the proper sales/service taxes. In Mexico, businesses are required to charge VAT(IVA) taxes on all products/services they sell. You can use our Single rate tax code calculator to make these tax rates available for use when creating invoices.

The tax code followed in the United Mexican States is

The Imposta sul Valore Aggiunto (IVA), is a value-added tax(VAT) and it is composed at the rate of 15% on all supplies of goods and services.

Reference:IVA-VAT tax rate of the United Mexican States is referred from Focus on mexico website.

Steps to Configure Taxes on Invoices App Settings

- Login and access Invoices App from your universal navigation menu bar.

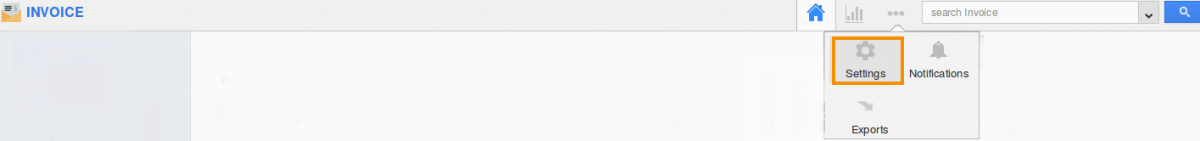

- Click on “More” and select "Settings" at the app header bar.

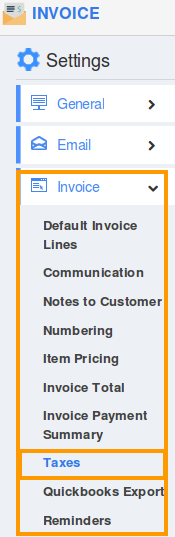

- Click on “Invoice” and select "Taxes" from the left navigation panel.

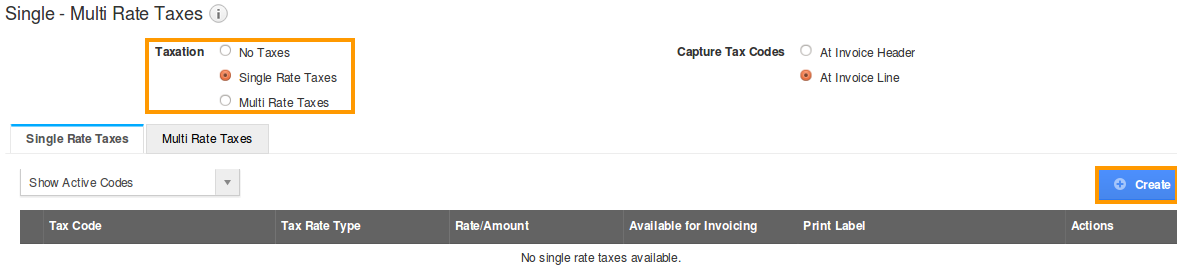

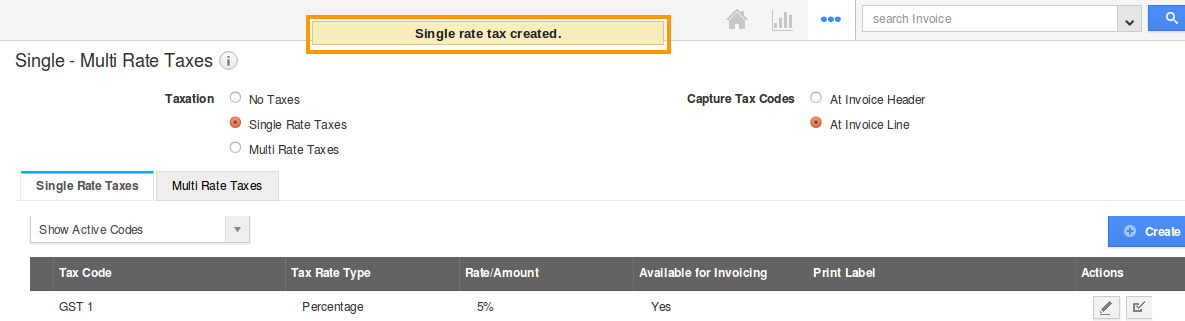

- Select “Single rate taxes” on taxation and click “Create” button.

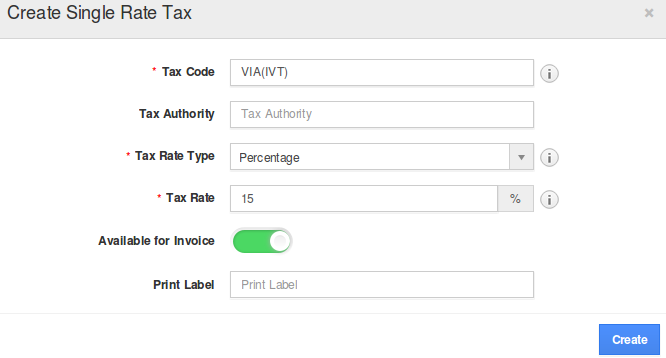

- Create single tax rate pop-up will emerge.

- To which provide tax code, tax rate type and tax rate (percentage or amount)

- In tax rate type, there are two options:

- Click “create” to get done with your Single tax formation, which indicates with a tax code created pop-up.

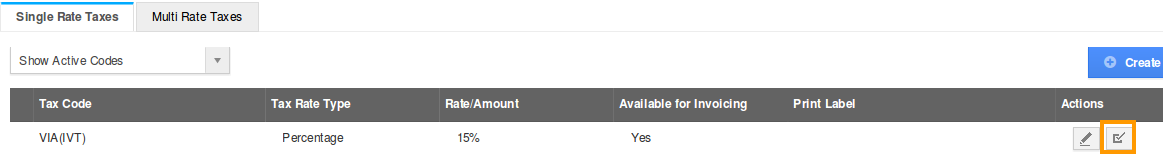

- You can enable or disable a tax code by clicking “plugin” symbol under the actions column.

- Now, we proceed with creating a new invoice with the above settings.

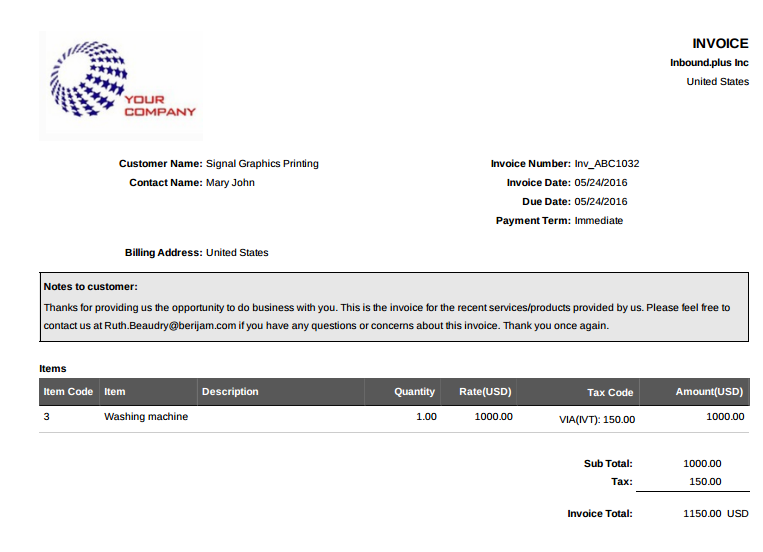

- You can either Email invoice with PDF attachment or manually print invoice to be provided to your customer.

- This is how a customer views Invoice tax code items subtotals in PDF format.

Follow this link to know more about Invoices tax code followed in various countries