Browse by Solutions

Browse by Solutions

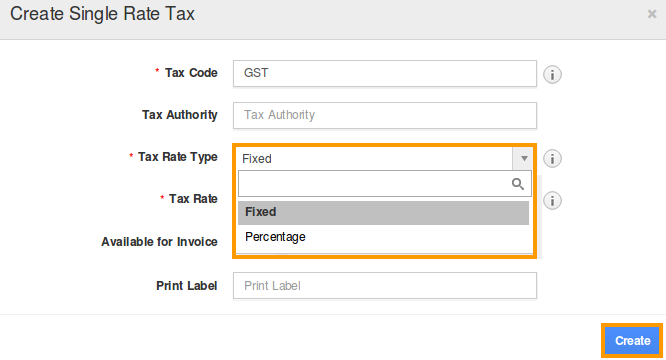

What are the Tax Rate Types found in single rate tax settings of Invoices App?

Updated on October 10, 2024 02:37AM by Admin

The Invoices App provides tax settings for the purpose of including taxation on the goods and services sold. Most regions around the world use a single rate tax code system. Calculating these taxes may differ from one place to another. In some geographical locations, taxes are levied on the basis of some percentage over the goods or services sold. While in other countries, a flat rate tax is levied against the sale. Based upon this variation, Apptivo has covered with two methods of tax rate types. They are as follows.

Fixed

Basically, a product/services will be provided with a standard tax amount which does not change regardless of price.The taxable amount of products differs from one another, so based upon the product/services sold taxable amount can be set.

Calculation of Tax: (Example)

If you sell a productservice worth 1000 Dollars

Selling price $ 1000.00

Tax (Fixed amount) $100.00

Total $ 1100.00

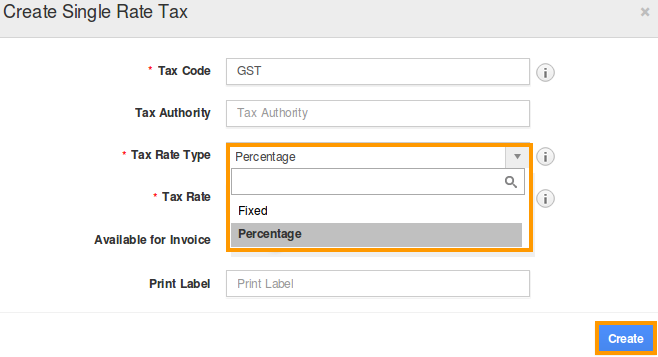

Percentage

It refers to the proportion of taxes to be levied on the product/ services sold. It is deducted from a total sales value of the product/services. The sales tax rates differ from country to country, so based upon the country’s tax rate system, calculation of taxes can be done

Calculation of Tax: (Example)

If you sell a productservice worth 1000 Dollars

Selling price $1000.00

10% of GST ($1000×5%) $100.00

Total $ 1100.00

You can select any of the above mentioned tax types based on your business needs. Thereafter, invoices created will be based upon the tax rate type configured in Invoices App.

Follow the link to know more about Invoices tax code settings in various countries