Browse by Solutions

Browse by Solutions

How to setup Invoices Tax code for North Rhine Westphalia, Federal Republic of Germany?

Updated on October 19, 2016 03:19AM by Admin

Users in North Rhine- Westphalia, Germany can easily set up their online Invoices to charge for the sales/services taxes. In North Rhine- Westphalia businesses are required to charge VAT taxes on all products/services they sell. You can use our Single rate tax code calculator to make these tax rates available for use when creating invoices.

The tax code followed in North Rhine- Westphalia, Germany

The Value Added Tax (VAT), is a form of consumption tax and it is collected at the standard rate of 19% on most supplies of goods and services. While a reduced rate of 7% applies to certain goods like books, food, transport etc..,

Reference: Value Added Tax (VAT) rates of North Rhine- Westphalia, Germany is referred from Wikipedia (Taxation in Germany) and Tax rates web sites.

Steps to Configure Taxes on Invoices App Settings

- Log in and access Invoices App from your universal navigation menu bar.

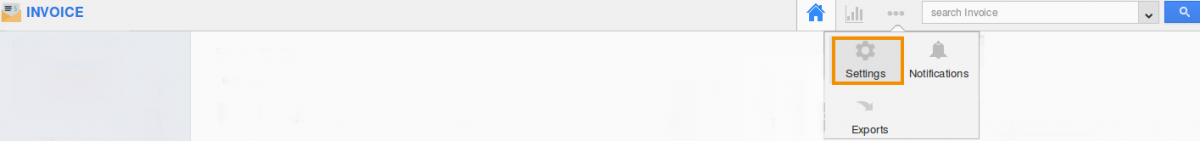

- Click on “More” icon and select "Settings" located in the app header bar.

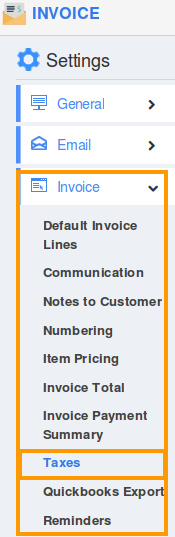

- Click on “Invoice” and select "Taxes" from left navigation panel.

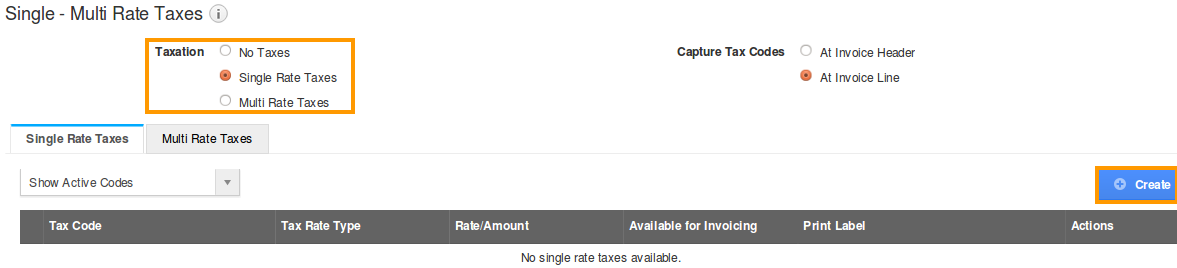

- Select “Single Rate Taxes” on taxation.

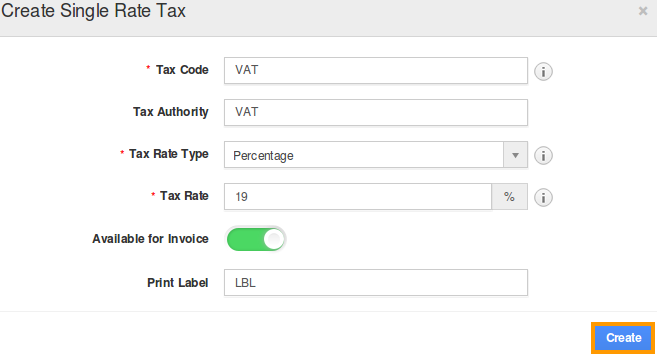

- Click “Create” button to create a single rate tax.

- Provide the following:

- Tax Code – Code of the tax.

- Tax Rate Type – Select a type either fixed or percentage.

- Tax Rate – Rate of the tax (percentage or amount).

- Print Label – Name of the tax.

- Click on “Create” button to complete.

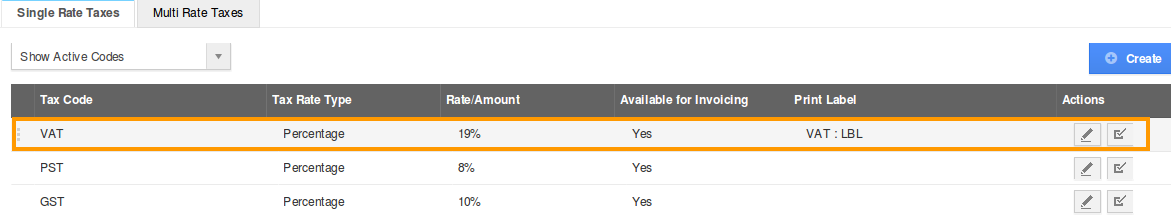

- You can view the created single rate tax code in a list.

- By default, the created single rate tax will be in enabled mode.

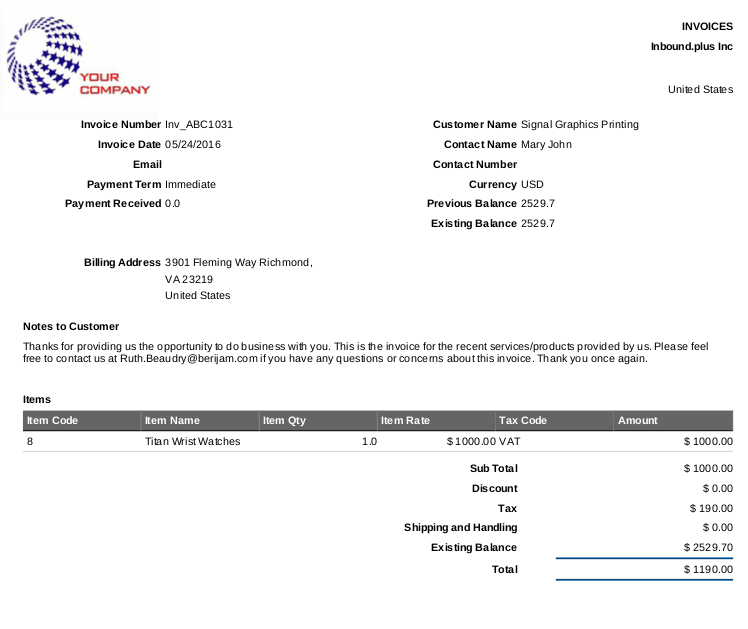

- You can proceed creating a new invoice with the above settings.

- You can either E-mail an invoice with PDF attachment or manually print invoice to the customer.

- You can view the invoice Tax code items subtotals on PDF format.

- You can capture the tax code at invoice header level and line level.