Browse by Solutions

Browse by Solutions

How to setup Invoices Tax code for Maharashtra, Republic of India?

Updated on October 19, 2016 03:34AM by Admin

Users in Maharashtra, Republic of India can easily set up their online Invoices to charge for the sales/services taxes. In Maharashtra businesses are required to charge VAT taxes on all products/services they sell. You can use our Single rate tax code calculator to make these tax rates available for use when creating invoices.

The Tax code followed in Maharashtra, Republic of India

The Value Added Tax (VAT), is a form of sales tax and it is collected at the standard rate of 12.5% on most supplies of goods and services. While a reduced rate of 4% applies to industrial inputs, capital merchandise and commodities of mass consumption.

Reference: Value Added Tax (VAT) rates of Maharashtra, India is referred from Business portal of India and Trade chakra web sites.

Steps to Configure Taxes on Invoices App Settings

- Log in and access Invoices App from your universal navigation menu bar.

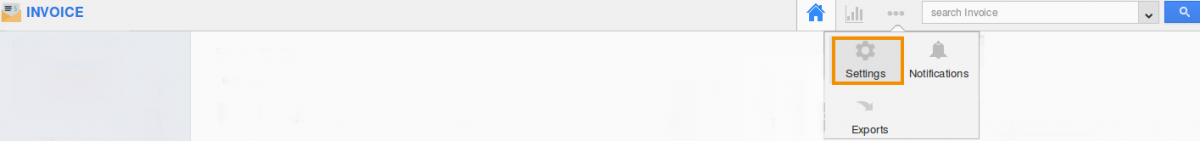

- Click on “More” icon and select "Settings" located in the app header bar.

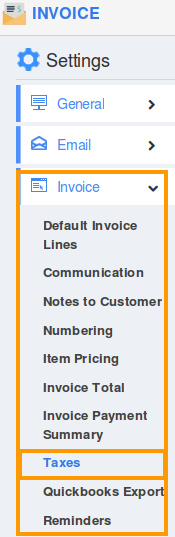

- Click on “Invoice” and select "Taxes" from left navigation panel.

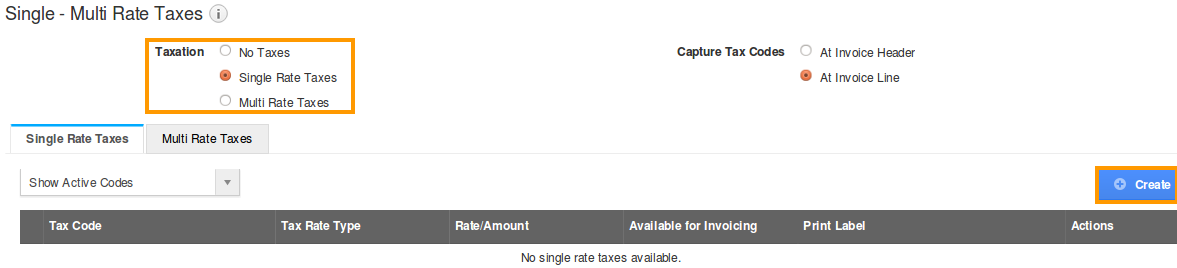

- Click “Single Rate Taxes” on taxation.

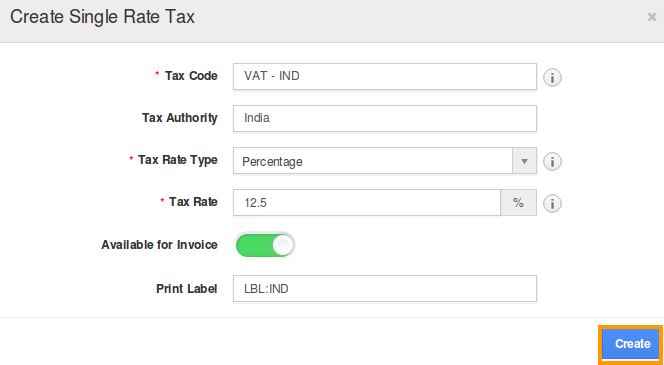

- Click on “Create” button to create a single rate tax.

- Provide the following:

- Tax Code – Code of the tax.

- Tax Rate Type – Select a type either fixed or percentage.

- Tax Rate – Rate of the tax (percentage or amount).

- Print Label – Name of the tax.

- Click on “Create” button to complete.

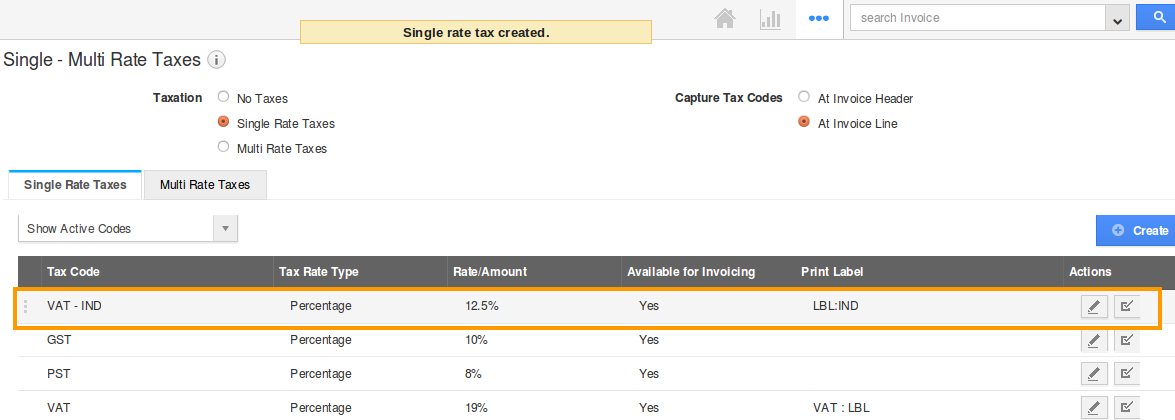

- You can view the created single rate tax code in a list.

- By default, the created single rate tax will be in enabled mode.

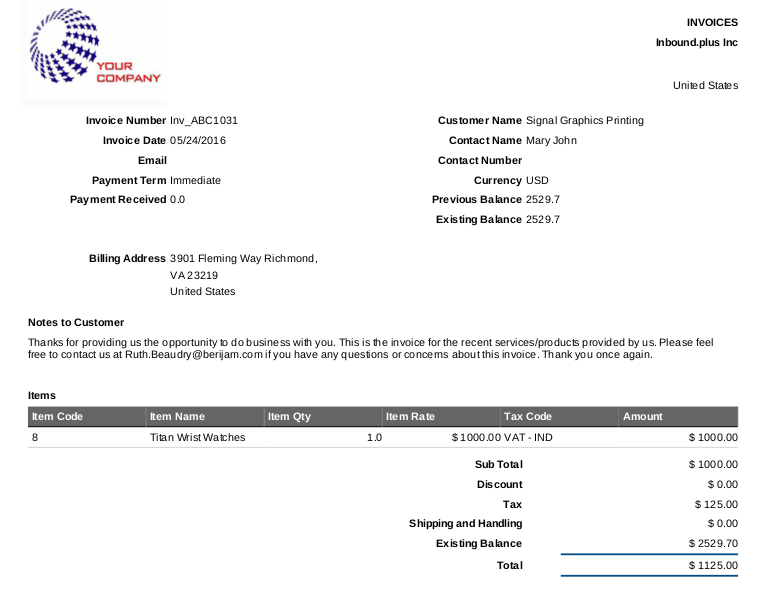

- You can proceed creating a new invoice with the above settings.

- You can either E-mail an invoice with PDF attachment or manually print invoice to the customer.

- You can view the invoice Tax code items subtotals on PDF format.

- You can capture the tax code at invoice header level and line level.