Browse by Solutions

Browse by Solutions

How do I Customize Single Rate Taxes in the Purchase Orders App?

Updated on June 15, 2017 12:29AM by Admin

Purchase Orders App allows you to create taxes manually by customizing "Taxes" tab which is provided in Purchase Orders settings.

The Purchase Orders App allows you to create both Single Rate Taxes and Multi Rate Taxes.

- Single Rate Taxes - Method of taxation exclusively on one tax.

- Multi Rate Taxes - Method of taxation on multiple ones.

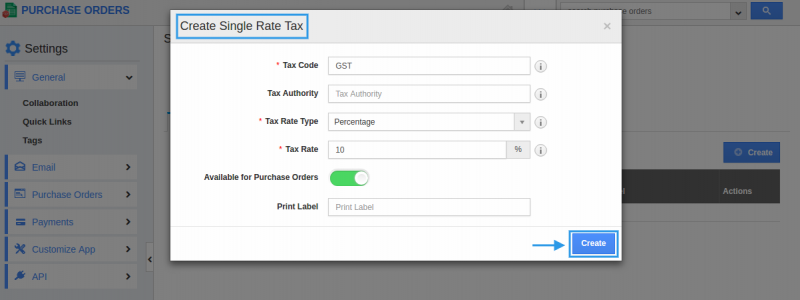

For instance: An Employee wants to create GST tax as a single-rate tax.

Steps to Customize Single Rate Taxes

- Go to Purchase Orders App from app header bar.

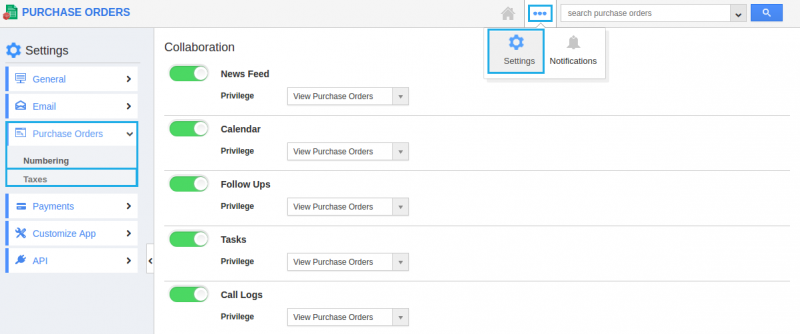

- Click on “More(...)” icon -> “Settings” -> “Purchase Orders” -> “Taxes”.

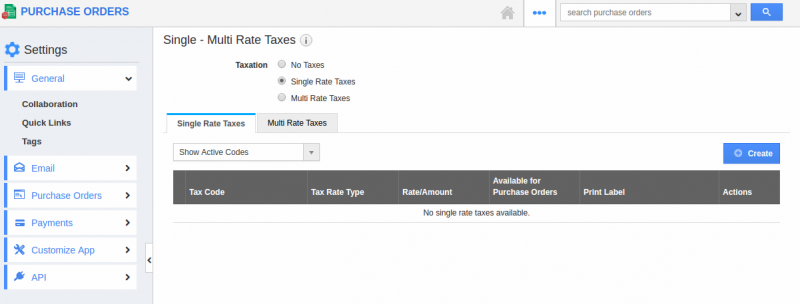

- The overview page of the taxes will be displayed as shown.

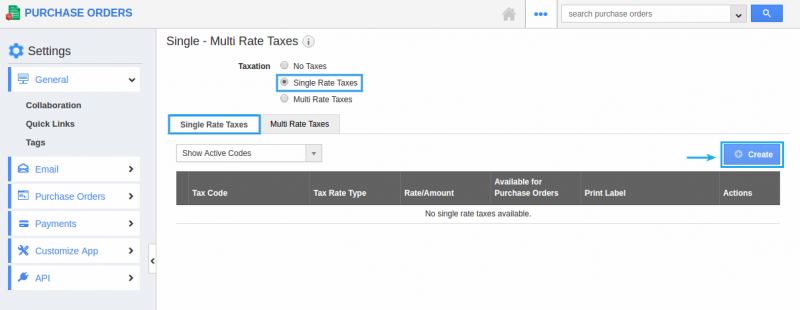

- Select “Single Rate Taxes” radio button at the top. Then, select “Single Rate Taxes” tab and click on “Create” button.

- You can view the “Create Single Rate Taxes” pop-up, where you can fill in the following details:

- Tax Code - The code of the tax.

- Tax Rate Type - The type of rate you want to charge (Percentage / Fixed).

- Tax Authority - The authority for whom you are paying this tax to.

- Tax Rate - The rate you would like to charge as tax.

- Available for Purchase Orders - Toggle ON to make the tax available for Purchase Orders.

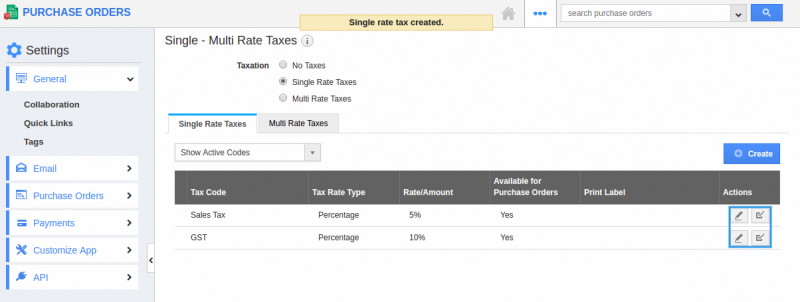

- Now, you can see the created single-rate taxes. You can also “Edit” or “Delete” using respective icons.

Related Links

Flag Question

Please explain why you are flagging this content (spam, duplicate question, inappropriate language, etc):