Browse by Solutions

Browse by Solutions

What Tax Rate Types are available in Multi Rate Taxes in Invoices App?

Updated on March 6, 2018 05:26PM by Admin

Invoices App provides two types of tax rates, while defining multi rate taxes. They are as follows.

- Flat Taxes

- Stacked Taxes

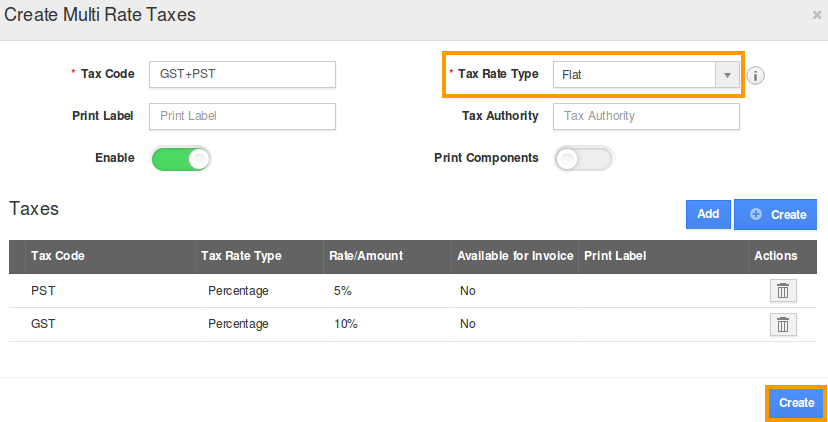

Flat Taxes

When you select the flat rate type, all taxes are individually applied on the invoice amount. For example, we have defined a tax code called “GST+PST” in the following screen with 2 component tax codes. Have a look.

- GST @10%

- PST @5%

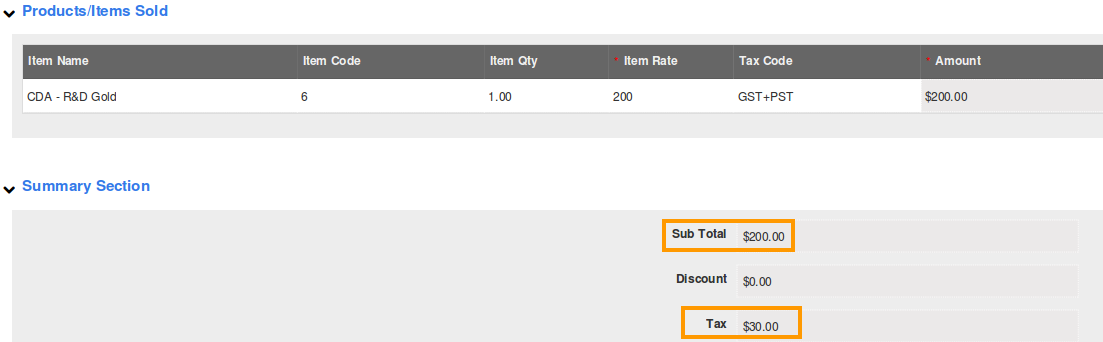

Lets say you have an invoice that totals to $200. When you apply the “GST+PST” tax code, taxes and the total invoice amount will be as follows:

Invoice amount = $200

GST @10% = $20

PST @5% = $10

Total = $230

This is shown in the sample invoice below.

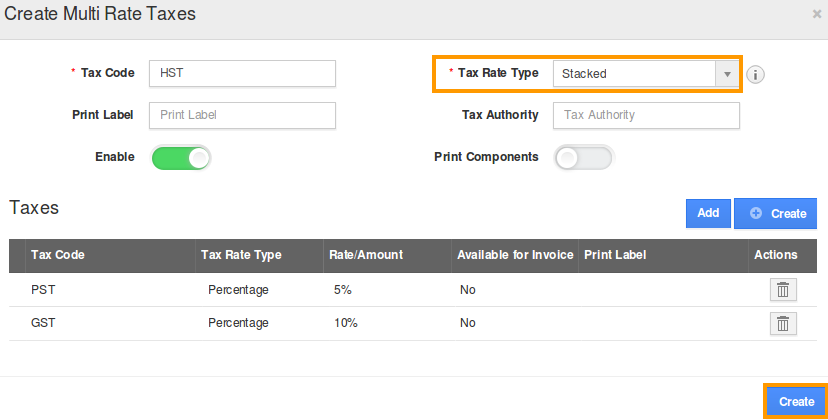

Stacked Taxes

When you select the stacked rate type, all taxes are applied cumulatively on the sum of the invoice amount and all the previously applied taxes. For example, we have defined tax codes called “GST and PST ” in the following screen with 2 component tax codes.

- GST @10%

- PST @5%

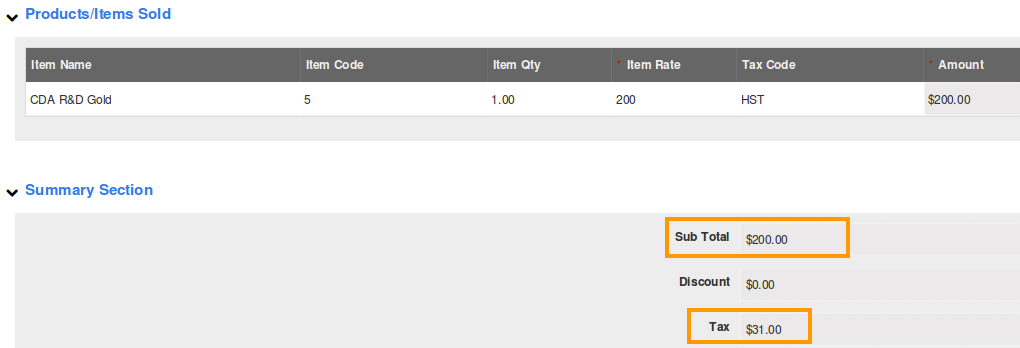

Let’s say you have an invoice that totals to $200. When you apply the “HST” tax code, taxes and the total invoice amount will be as follows:

Invoice amount = $200

GST @10% = $20

PST @5% on $220 = $11

Total = $231

This is shown in the sample invoice below.

You can use flat or stacked tax rates as needed by your business. We also have specific tax code posts for various countries. Click on Invoices tax code settings in various countries to access those posts.